Dollar Cost Averaging - Taking the Guesswork Out of Investing

How does this strategy work?

Dollar cost averaging is a simple concept that can work really well when investing on a regular basis via a unit trust. Assuming you invest a set amount each month, your money will buy more units when the unit price falls, and fewer units when the unit price falls.

Let’s say you invest $200 per month in a managed share fund over a five-month period. For illustrative purposes, we have assumed the unit price drops from $10 to $5, before returning to $10 at the end of the fifth month.

You may think it would be hard to make any money. After all, the unit price ended up at exactly the same point as it started. However, during the months when the unit price is lower, you can buy more units with your $200. As shown in the table below, investing a total of $1000 over five months, you are able to purchase 140 units. At the end of the period these units are worth $1,400 – representing a profit of $400.

Month |

Monthly investment |

Unit price |

Units purchased |

1 |

$200 |

$10.00 |

20 |

2 |

$200 |

$6.66 |

30 |

3 |

$200 |

$5.00 |

40 |

4 |

$200 |

$6.66 |

30 |

5 |

$200 |

$10.00 |

20 |

Total |

$1,000 |

|

140 |

Average price paid = $7.14 (ie $1,000/140 units)

Investments value at the end of 5 months = $1,400

(ie 140 units @ $10 each)

Case Study

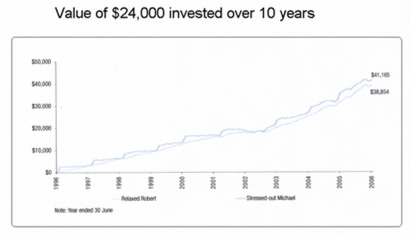

Robert and Michael each want to invest $2,400 a year in a balanced fund unit trust for ten years. Robert decides to use dollar cost averaging and arranges for $200 to be transferred from his bank account on the same day each month.

Michael, on the other hand, decides to invest $2,400 as a yearly lump sum when the market is at its lowest. That way, he can purchase more units with his money. After spending a lot of time monitoring unit prices, Michael surprisingly ends up investing at the lowest price every year. But was it worth it?

Despite all Michael’s hard work over the ten years, there is only around $2,000 difference between the value of their investments, as the graph below reveals. This also assumes Michael is lucky enough to pick the right time to invest each year – a difficult task that could easily have backfired.

Click on the image to see a larger version

*The example assumes Robert invests $200 at the end of each month, whereas Michael invests $2,400 at the lowest price each year. It also assumes both Robert and Michael invest in a balanced fund comprising 35% in Australian shares, 25% in global shared, 10% in property securities and 30% in Australian bonds. This is based on the asset allocation of the Average Balanced Fund from the Mercer Wholesale Manager Performance Analytics software as at 31 May 2006. The performance indices used on page 10 and 11 are: Australian Shares – All Ordinaries Accumulation Index; Global Shares – MSCI World Gross Accumulation Index ($A); Property Securities – ASX 200 Property Accumulation Index; Australian Bonds – UBS Warburg Composite Bond Index All Maturities (prior to Oct 1989 – Commonwealth Bank Bond Accumulation Index); Cash – UBS Warburg Bank Bill (prior to Apr 1987 – 13 Week Treasury Notes Rate). All earnings are reinvested but do not take into account the impact of fees or taxes on distributed income and capital gains. This example is based on historical performance and is not indicative of future performance. Future performance is not guaranteed and is dependent upon economic conditions, investment management and future taxation.

There are two reasons why the value of Robert’s investments was so close to Michael’s:

- Robert didn’t try to time the market, so when the unit price was low his money automatically bought more units.

- By investing on a monthly basis, Robert allowed his money to benefit from the power of compounding returns.

The Benefits

- Takes the guesswork and emotion out of picking the right time to buy and sell.

- Allows you to start investing earlier as you don’t necessarily need to have a substantial amount before you begin.

Tips and traps

- Investing in shared or property (either directly or via a unit trust) allows you to access the potential for long-term capital growth.

- An easy way to implement this strategy is to pay yourself first (is invest a fixed amount of your salary each month before you spend your money on other things).

- You can purchase units in a unit trust automatically by arranging to have money transferred directly from your bank account or your salary. Direct debit is available through most financial institutions and fund managers.

- By reinvesting your income to purchase additional units, your regular investments can benefit from the power of compound returns.

- To accelerate the creation of wealth, you could consider instalment gearing, which allows you to supplement your regular investments into a unit trust with regular drawdowns from an investment loan.

If this sounds like what you are after, please call our experienced team of financial planners on (02) 9438 3233, to help get your investment strategy underway now.

|